Challenge

Can we use generative research to identify an opportunity for innovation, drive strategy, and help prioritize new features for our existing online experiences?

My Role

I was the lead on the project, managing everything from research design, recruiting, and facilitating. My UX team assisted with transcribing interviews and the creation of the affinity diagram.

Process

Interviews

I worked with an outside recruiter to find participants who recently did at least one of the following:

• Purchased insurance

• Had an insurance-related life event

• Had a claim

During the interviews, we asked participants to describe what they use for every day things such as TV service, personal banking, credit cards, filing taxes, grocery and household shopping and share how they decide what to use or where to shop.

We also asked what comes to mind when they hear the term "insurance."

Once we learned more about their perspective of insurance, we asked them to describe their process for how they go about researching insurance -- where they go for information and what questions they have, and ultimately, what made them decide to go with a certain carrier.

"When someone I know says something really bad about a company, that really sticks with me." Linda C.

"I chose Prudential for life insurance because my parents use them." Kara M.

"She bundled our personal taxes with the corporate ones and it just makes it easier and cheaper." Chis H.

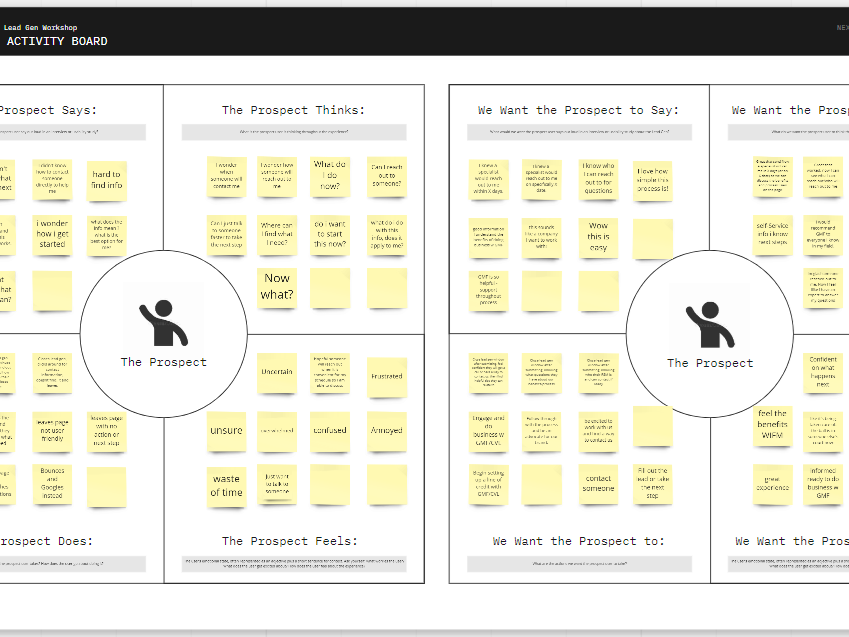

Affinity Diagram

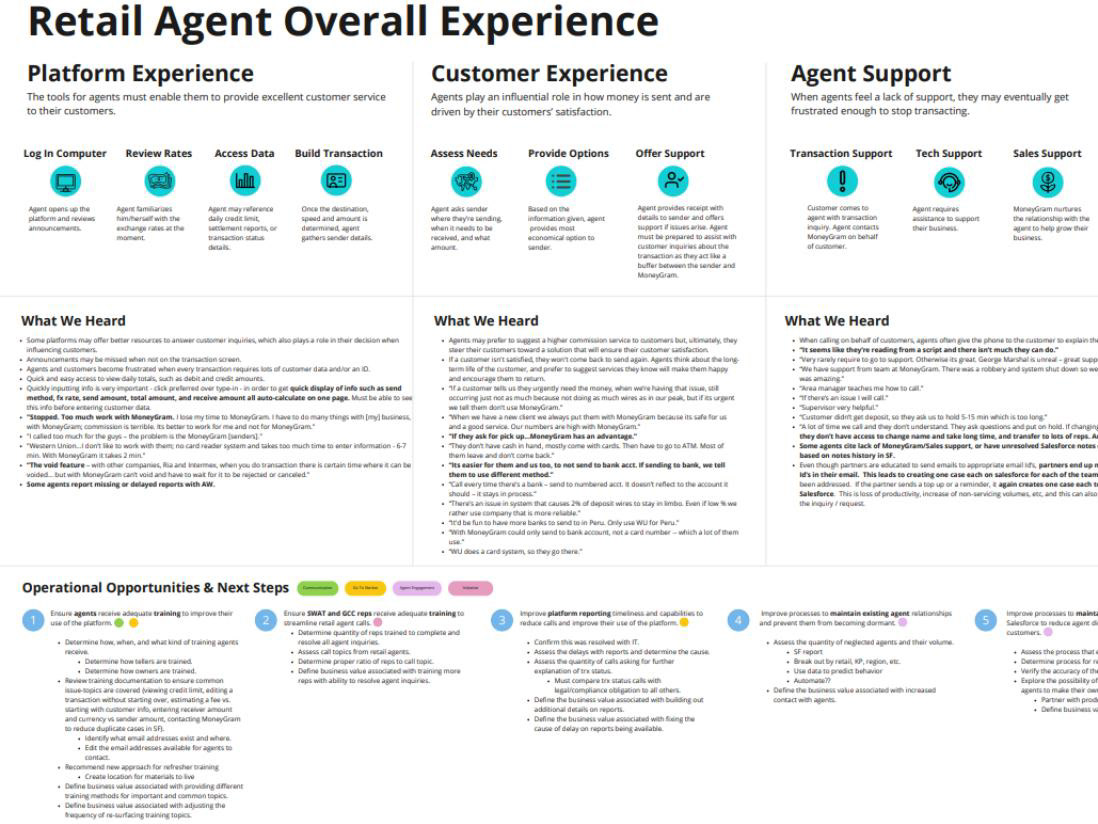

To organize our notes from the 16 interviews, we created an affinity diagram. Through this process of grouping notes by meaning, we were able to reveal key insights.

We learned that recommendations from friends and family carry a lot of weight, and sometimes "asking around" is the extent of the research people do when deciding on products and services.

Further, once someone has a good experience, they'll usually stick with that company for a while -- or even add new products/services.

There are some, though, who are just looking for the best deal and will hop from company to the next each year just looking for a deal. Often times bundling services will get people that deal they're looking for.

Ideation

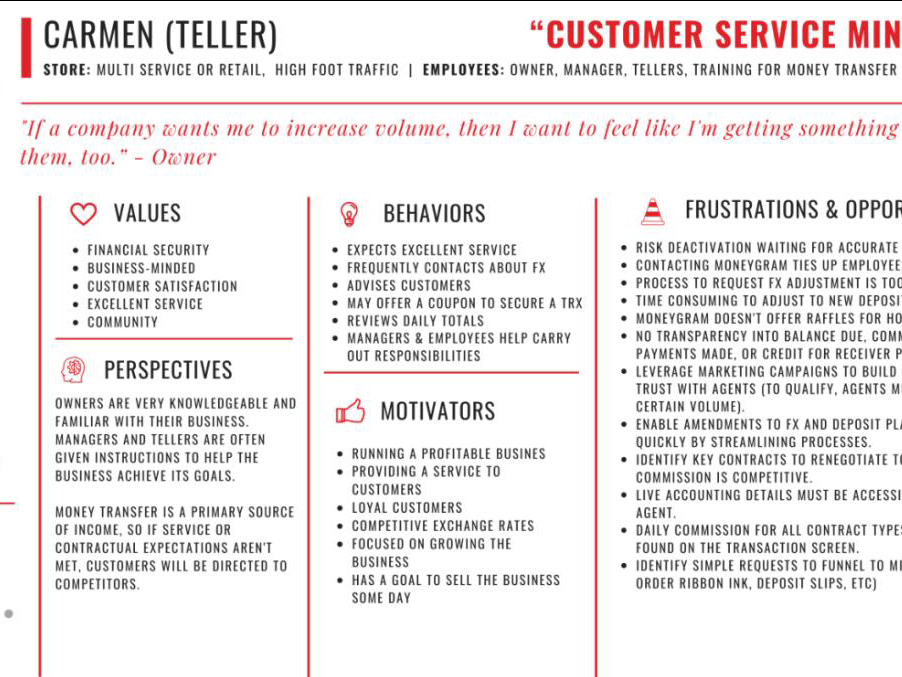

Each team member "walked the wall" looking for innovation opportunities to share with our business and product partners.

The concept I came up with was centered around three key insights--

• Price determines whether or not I get insurance.

• How much I need and how much I can afford are entirely different things.

• I weigh the cost of insurance just like everything else in my budget.

My concept was to "save now, buy later." The perception of insurance is that its expensive. I wondered, how can we help people incrementally save for insurance over time so that they don't have to choose between groceries or insurance?

Insurance is something that many people know they need, but sometimes have a hard time carving out room for it in their budget. Since we know that some life events coincide with needing to purchase new insurance, we can help people save for insurance that they'll need in the future. Automatically putting a small, set dollar amount aside every day towards an insurance policy would ensure people are able to afford a policy when they need it most.

Imagine Steve, who's planning to start a family with his wife in the next few years. While they're excited to expand their family, they're a little nervous about taking on the extra expenses associated with having their first child – including life insurance. By setting aside money now, they can make sure they'll be able to afford a new life insurance policy during a time where they'll be more focused on buying diapers than insurance.

Its like a savings account just for life insurance.

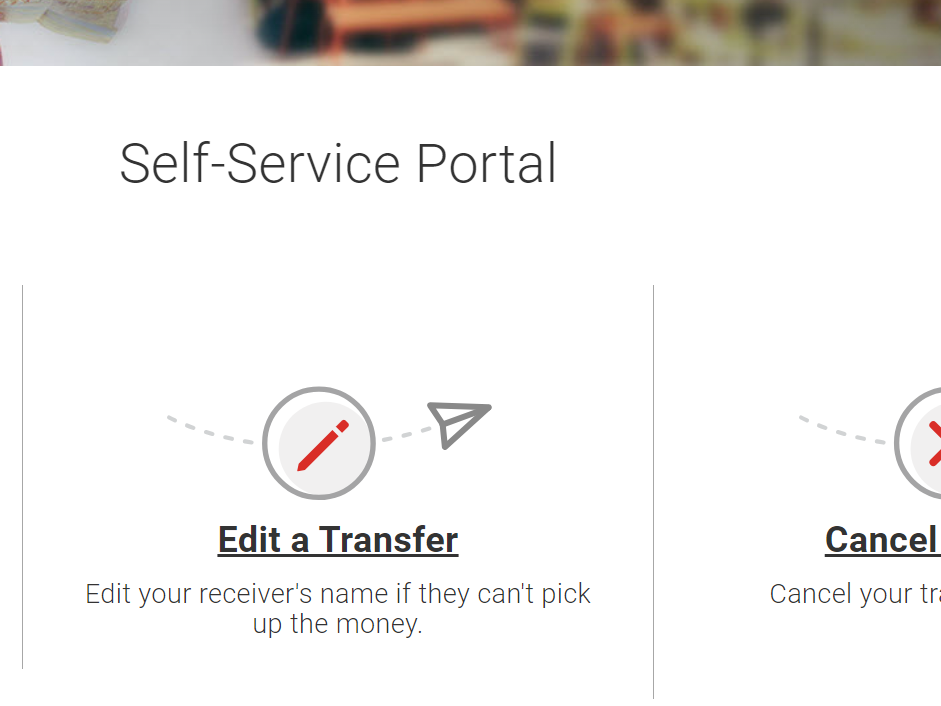

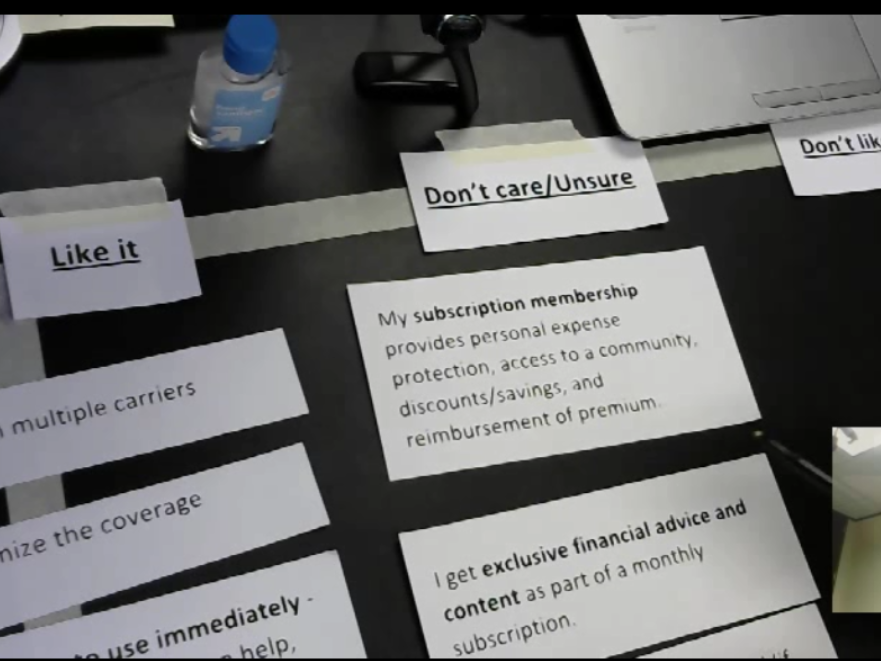

Prototyping

I wanted a simple design that went with my pitch, just to get people visualizing what an app like this could look like.

I'm currently working on further fleshing this concept out.